Turning Wisconsin Into South Carolina

I recently stumbled upon a report from the U.S. Chamber of Commerce that explains much of what is going on in Wisconsin, Ohio, Indiana, and other states across the country.

The report is entitled The Impact of State Employment Policies on Job Growth – A 50-State Review.

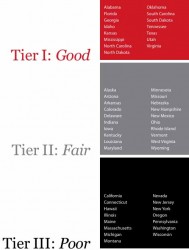

A quick executive summary of this report is that Wisconsin should become more like South Carolina. California should become more like Mississippi. Massachusetts should become more like Kansas.

According to the Chamber:

States with a “Good” rating have strong pro-employment policies, with opportunities for improvement limited to a few specific areas. States with a “Fair” rating have some pro-employment policies, but are also falling short in a number of areas. States receiving a “Poor” rating have polices that inhibit job creation in most categories, and have the potential to substantially increase job growth by adopting less burdensome policies.

Here’s some more excerpts from the report:

Minimum Wage Laws and Living Wage Laws

An important effect of state-level minimum wages is to increase the wage bill for employers in affected states. Unlike certain other policies, such as corporate income taxes, minimum wages increase costs for a relatively select set of employers.

In particular, employers of low-skilled, entry-level labor such as restaurants and retail establishments experience significant increases in their labor costs, whereas employers of high-skilled, advanced-career labor experience relatively smaller effects.

To the extent small businesses are more likely to rely on lower- paid workers, minimum wages may disproportionately affect new business formation.

Translation: Stick to the Federal minimum wage. Don’t try to improve the lives of your constituents.

Unemployment Insurance and Workers’ Compensation

Unemployment insurance (UI) and workers’ compensation (WC) are insurance programs that compensate workers in cases of: (a) involuntary unemployment due to layoffs (for UI) or (b) injuries or illnesses resulting from work-related activities. While both types of insurance have obvious benefits, they also impose employment-related costs on employers (in particular payroll- related premiums to support both programs) and affect the incentives of employees. There is strong empirical evidence that higher unemployment insurance and workers’ compensation benefit levels results in lower levels of employment.

Translation:Bye-bye workers’ compensation and unemployment insurance.

Wage and Hour Policies

At a minimum, expansions of federal law, as in California, alter the structure of compensation systems, essentially imposing a tax on workday/workweek flexibility. They may also raise labor costs overall. The empirical evidence generally suggests that the effect of overtime regulation is to raise wage rates and reduce employment.

Additional wage and hour requirements also have a variety of other distorting effects. For example, one recent study found that overtime coverage causes firms to substitute more expensive for less expensive labor, “redistributing income from lower to higher earning workers.” State wage and hour laws also impose increased timekeeping and time-monitoring obligations on employers. In California, for example, employers have increasingly begun to monitor their employees’ time on a real-time basis so as to forestall litigation related to state daily overtime or meal-break rules.

Translation: Again, stick to the bare minimum of what’s required by Federal law.

Collective Bargaining Issues

The overwhelming weight of economic research suggests that higher rates of unionization lead to higher labor costs above the market rate. Recently there has been increasing concern about the role public-sector unions in particular play in influencing government policy and impacting labor markets.

Translation: We don’t have any evidence that public unions impact the creation of new businesses, but we should probably go after them anyways because they’re unions.

Litigation and Enforcement Climate

A sixth category of employment policies utilized in this study seeks to capture cross-state variations in the litigation and enforcement environment relating to employment and labor issues. There is a substantial body of economic evidence suggesting that these factors, while sometimes difficult to quantify, distort markets and have a negative impact on economic performance.

For example, much of the research on the effects of worker-separation policies (e.g., the employment- at-will doctrine) relates directly to the propensity of employees (or state labor departments) to engage in litigation (and/or enforcement activities) that raises the costs to employers of conducting necessary worker separations.

Translation: We need laws to stop you people from suing us for the illegal things we do.

What’s Wrong With This Picture?

The Chamber has put together a very impressive looking report. It has lots of statistics and economic citations and looks quite compelling.

But something just doesn’t seem right.

California has been our leading economic innovator for years. Massachusetts is another high-tech zone. Illinois and New York are still economic powerhouses. Washington and Oregon are leaders in the Midwest. Yet all of these states are listed under “poor”.

And while I have nothing against South Carolina, Alabama, Mississippi, Oklahoma, South Dakota, or Kansas, I don’t usually think of these states in the same light as California or Massachusetts.

Many businesses have relocated to the South – mostly, from what I understand, due to generous tax breaks they received.

I just wonder where China would be on this report if they gave China an ERI score. My guess is that it would be in a category far above “Good”.

China would be up there in a new category titled “Amazing” because they have no minimum wage. They have no collective bargaining. They have no right to sue their employers and my guess is that Workers’ Compensation and Unemployment Insurance are unheard of in the Peoples Republic.

I understand the basic argument in the report: drive down the costs for employers, and maybe more will come to your state.

Its the classic pitting states against each other to lower the costs for companies who relocate.

But isn’t this a “race to the bottom”? While you may attract more business, what kind of jobs will they be? According to the Chamber, lower wage jobs with fewer and fewer benefits. Basically, what’s been going on for the past 30 years.

And you’re rewarding employers who pay ever less and shift more of their burden onto the Federal government. We’ve created a system of incentives which rewards those who provide ever less to their employees.

What I don’t understand is why we and the U.S. Chamber of Commerce aren’t fighting to turn the incentive system around.

Instead of creating a system where the role of government is shifting ever more costs onto individuals and reducing their pay and benefits, why not reward employers who innovate, who create higher paying jobs, who bring better, higher-margin businesses to states?

Can’t we have a balance between what’s good for middle-class families and what’s good for corporations?

Why not fight to raise the standard of living in places like South Carolina instead of working to lower the standard of living in Wisconsin?