Robert Reich’s “Saving Capitalism” or how to have better conversations about the economy

A few weeks back, I saw Robert Reich speak at Joseph-Beth Booksellers here in Cincinnati. He is an outstanding speaker and if you ever have the chance, go see him talk. Brilliant. Funny. Experienced. Gregarious. He is just as good in person as his writing.

He started out by joking that his new book alienated everyone. He said, half the people I spoke with said, what needs saving? And the other half said, why save it? First of all, I could tell he spoke with a lot of people on both sides because he spoke about the elephant in the room – how the conversation is so often framed. And second of all, he used this as a great segue to how to get out of this trap we so often face, that the conversation comes down to some kind of less government/more government argument. The beauty of Reich’s book isn’t necessarily economic. The beauty of it is that Reich understands how to have better conversations with people about the economy. This ability to have better conversations about the economy is important because almost every discussion relates back in some way to our views about the economy. Every one. So today, I’m going to set aside self-publishing and talk about a few of the things Reich said, because this is a conversation I have with people all the time, and his new book, Saving Capitalism.

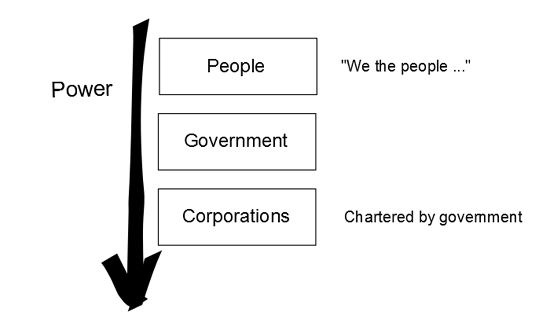

Reich starts out his book by outlining how in every debate, in every discussion, regardless of the issue, the conversation turns into whether the “free market” is better at doing something than the government. Sound familiar? I’ve had this conversation going on I think about a million times. If it’s health care, is it the market or government? If it’s education, is it the market or government? If it’s defense, is it the market or government? If it’s utilities, is it the market or government? The premise of Reich’s book is that this conversation is useless because it’s not markets or government. It’s not markets vs. government in some kind of steel cage wrestling match. It’s not one or the other. Markets can’t exist without government. Robert Reich:

There can be no “free market” without government. The “free market” does not exist in the wilds beyond the reach of civilization. Competition in the wild is a contest for survival in which the largest and strongest typically win. Civilization, by contrast, is defined by rules; rules create markets, and governments generate the rules.

Government doesn’t “intrude on” or “pervert” markets. Government creates markets. This simple fact is why you see so many corporate special interest groups. Corporations want government to create the rules in their favor. They’re not in Washington arguing in favor of less government. They’re in Washington lobbying for a different government, one in which the rules favor them. We create markets. Markets don’t exist in the wild. You don’t walk along a path and suddenly spy a free roaming market. They’re not trapped in cages. People came up with the idea of bartering. Then, they came up with the idea of money. They also came up with rules around how trading should work. Rules that are fair. Many of these rules became laws. Different countries have different rules. So any conversation that is about “freeing” markets or “restricting” markets is a false one. These are just marketing terms used by corporate special interest groups because they sound good to people. Who doesn’t want more freedom? Now another way to put this is that you too can talk about freeing markets. This is what we, as liberals, tend not to like. We tend to like academic arguments. We tend to think of talk about “freedom” as bullshit. And so the corporate special interest groups claim the territory. Just as they’ve claimed the discussion about the economy This is why I like Robert Reich. Because he understands the importance of ideas. Especially about the economy. And, more importantly, he understands that you can’t convince people of this by telling them that they’re full of shit, an approach we often try.

You can’t convince anyone of anything by telling them they’re full of shit

I suppose it makes good entertainment and it may make you feel better, but it doesn’t work. If you don’t believe me though, try it.

Most liberals I know are now at the point where they’ll say to me something like, “Yeah, yeah. I get it. You can’t tell people what to do. You have to be nice.” Or, “You have to speak to the heart.”

Definitely progress. I think I’ve reached them.

Then I watch them go back to the same things they were doing before that they just admitted weren’t working.

It has nothing to do with being nice or not nice. Speaking to the heart is getting closer.

I can tell they’re starting to get it and when I see this, I’ll try to pop in and help them out.

It has everything to do with the fact that it’s very difficult to “unstick” a bad idea.

The idea that “less government = good” is a bad idea. Not only that, but it’s the bad idea at the heart of almost every conservative argument.

Think about it for a second. This bad idea – this idea that led us to the 2008 market crash – survived the market crash. That is the power of this bad idea. It survived when billion dollar companies like Lehman Brothers and Merrill Lynch didn’t. It survived when our economy itself almost didn’t.

Just like end-of-worlders who aren’t convinced that the world won’t end when it fails to end on the date they predicted don’t stop believing in the end of the world, “free marketers” didn’t stop believing in freeing markets when their experiment crashed the economy.

To get rid of a bad idea, you need a better idea

This is why I like Robert Reich. He gets this.

Don’t fall into the trap of arguing more or less government with someone. This is clearly the fight they want. It’s also the fight corporate special interest groups have figured out is their best chance. They’ve used it for years and they’re going to keep running the ball up the middle until someone stops them.

Instead, talk about how people create markets and how we have choices when we create these markets. We can create them so they benefit a few. Or we can create them so they benefit everyone.

Either way, though, we’re creating the rules. We can create black markets. We can create slave markets. Or we can create markets for durable goods. We can create markets for food and services. We can create markets that preserve our resources. Or we can create markets that destroy our resources.

The choice is up to us.

This is the power of Reich’s Saving Capitalism and this was the power of his talk.

He wants to help you have better conversations about the economy with people. Instead of arguing, he wants you to be able to talk about better ideas.

Five aspects of the economy we create

It may take some time with people to establish this idea that we create markets. But it’s well worth it. Because after you establish this idea then the conversation becomes about what the markets should look like.

Reich talks about some of the decisions we make around:

- Property: what can be owned

- Monopoly: what degree of market power is permissible

- Contract: what can be bought and sold, and on what terms

- Bankruptcy: what happens when someone can’t pay

- Enforcement: how to make sure people don’t cheat

You might think some of these are simple. But they’re not. Not even property. For example, can people own slaves? Can they own a nuclear bomb? An idea?

Reich demonstrates how to illustrate the rules we create through examples. Because you can’t convince people of anything by telling them they’re full of shit.

One great example being the cable industry. It’s a great example because many people have cable and many people know that our cable companies are notorious for bad service. IN 2014, the U.S. had some of the highest prices for broadband in the world and some of the slowest Internet speeds.

Why?

Because the markets that were set up for these cable companies are regional monopolies. They don’t compete with each other. So why spend any money on better service or faster networks when there’s very little competition?

When it comes to fiber connections, the U.S. is behind Sweden, Estonia, Hong Kong, Japan, South Korea, and most other developed countries.

Why? Because these regional monopolies worked with government to write the rules to prioritize profit. For them. Even as they told people they shouldn’t be involved in markets.

This is an example of how we create markets. If we created them better, we would have better service and Internet speeds at lower prices.

A brief overview of the rest of the book

The rest of Reich’s book goes into more detail about some of these aspects of markets, how corporate special interest groups are creating them in their favor, the threat to capitalism and democracy, and the types of markets we want to create.

In short, Reich believes we need to reestablish mechanisms of countervailing power, mechanisms that create and/or lead towards better, fairer markets. A few examples of countervailing forces include:

- Breaking up monopolies like the 5 biggest banks

- Ending subsidies for our wealthiest corporations

- Getting money out of politics through public financing of elections

- Better regulations such as Glass-Steagall

- Democracy

- Groups such as churches, unions, local organizations, professional organizations

Why this is so important

If you want to read a pure book about economics, there’s better books by people whose primary field is economics.

What Reich does that few economists do is translate economics into conversations that you can have with people you know. He shows you how to break out of the corporate special interest group framing of more vs. less government. If you’re having these discussions, stop. You’ve already lost.

Establish that we create markets. Then, and only then, can you start talking about what these markets should look like.

—

|

David Akadjian is the author of The Little Book of Revolution: A Distributive Strategy for Democracy. Follow @akadjian |