Why we have a progressive income tax

Pictures are a really powerful way to tell a story. If you can find an easy way to explain something through pictures, you can often make great strides in a very short period of time.

One of the things that often gets brought up in conversations with conservatives is this idea of a flat tax. Many conservatives think this is somehow “fair.”

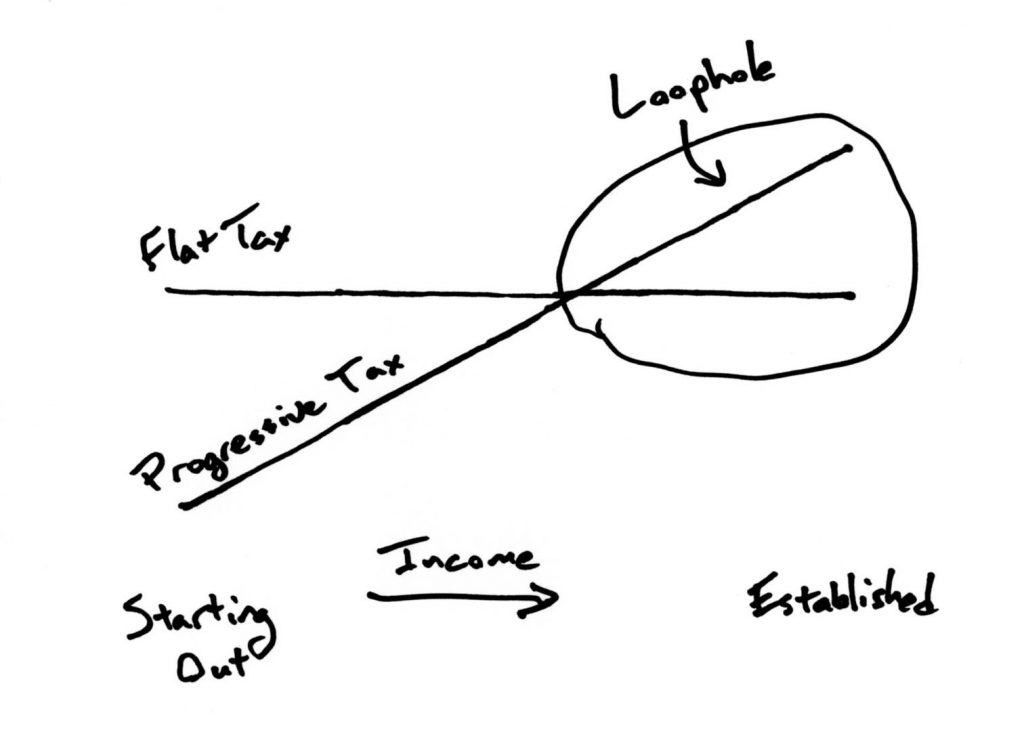

Here’s a simple drawing to illustrate why we have a progressive tax and to show how the flat tax is really just a loophole for the wealthy.

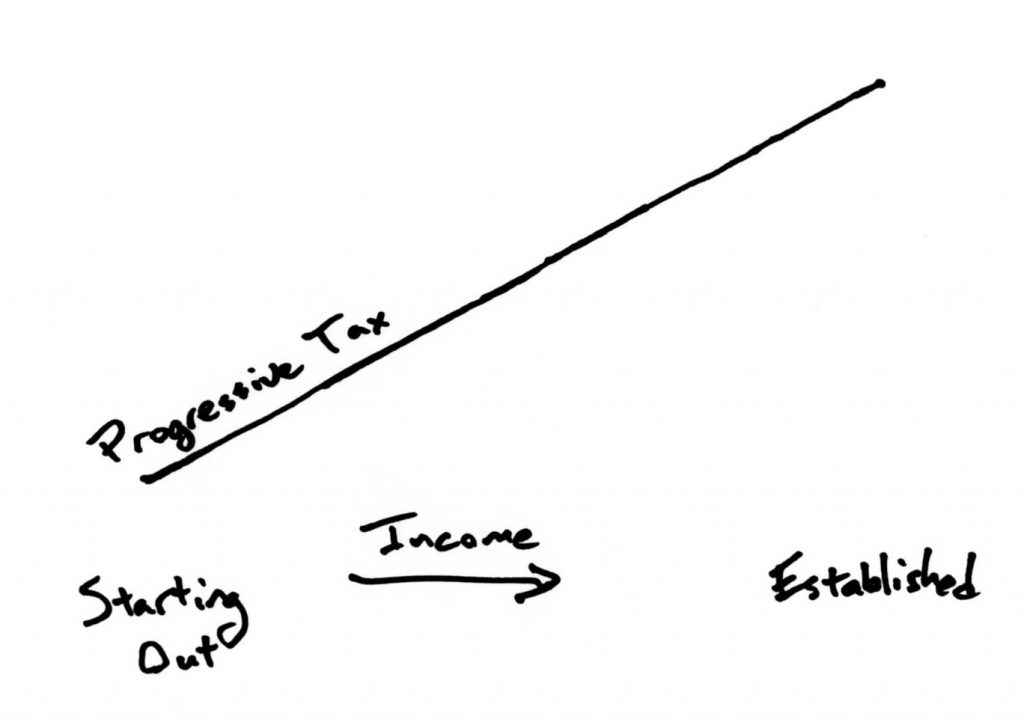

Start by drawing a progressive tax.

The idea behind a progressive tax is that as you benefit more, you pay back more to help make sure there’s opportunity for everyone. The idea behind the progressive tax is that you receive help when you’re starting out and, as you become more established and benefit, pay forward more.

A few benefits of a progressive income tax are:

- Creating opportunity

- Allowing people to gradually contribute more as they do better

- Helping small businesses and average people

- Helping consumers

- Keeping wealth inequality from skyrocketing and limiting concentration of wealth/power

- Allowing government to reinvest in things that benefit everyone such as infrastructure and transportation

- Helping upward mobility by keeping the burden off of people as they’re starting out

- Building a middle class

Explaining these benefits helps people understand the “why” behind progressive taxes. You want to be sure to establish the “why.”

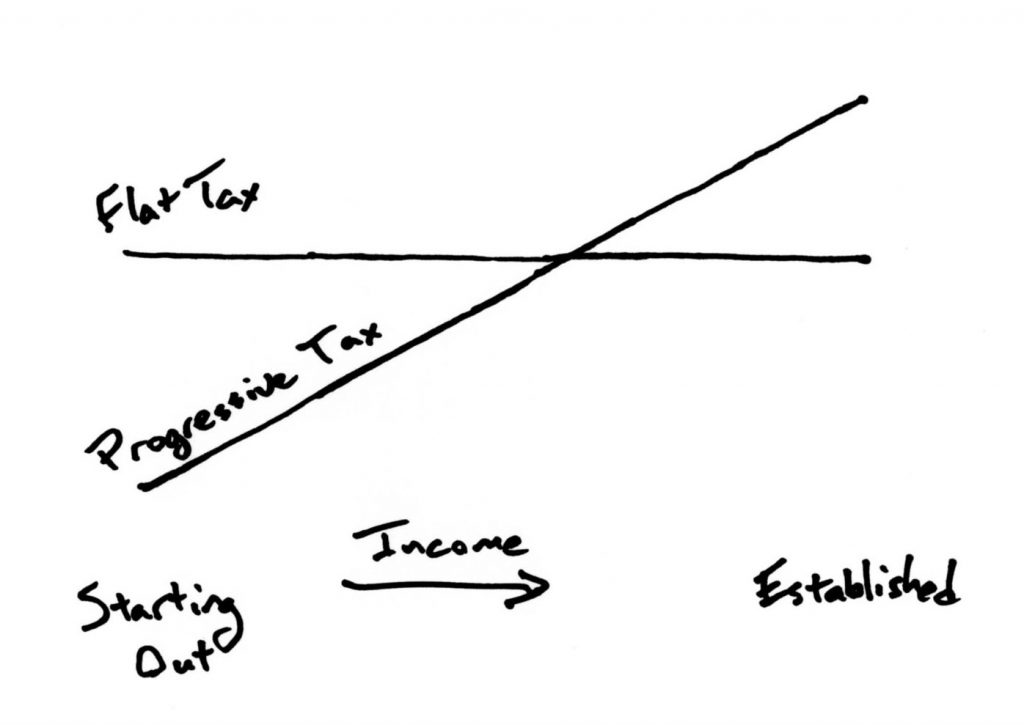

Then, draw a flat tax.

This is what a flat income tax looks like. A flat tax:

- Burdens those just starting out

- Stifles upward mobility

- Concentrates wealth and power with established interests

Notice how with a flat tax people who are just starting out or who aren’t established have to pay more.

Really it’s nothing more than another loophole for the wealthy. Since my friend couldn’t see how a flat tax was a loophole for the wealthy, I drew it for him.

The established rich pay less, everyone else pays more.

Another way to say this is that the wealthy and established are making it harder and harder for people to get ahead by shifting the burden onto those who are just starting out. This hurts small businesses and rewards larger, established businesses.

When you draw this picture, it makes it very clear what the real purpose of a flat tax (or “fair tax” as the marketeers often call it) is and eliminates any further talk of a flat tax. The added benefit is that it gives you an opportunity to talk about why progressive taxes are so important, and how they create a middle class.

As a country, we have choices. We can create our economic system so it benefits a very few—or we can create it so it benefits everyone.

David Akadjian is the author of The Little Book of Revolution: A Distributive Strategy for Democracy. Cross posted at Daily Kos.

One Comment