Distribute it right to begin with

Corporate special interest groups have hit upon a very powerful framing of the economy and government that involves something they call “redistribution”.

It has been played over and over in the media more than any annoying pop ballad I can remember. So much so in fact that I bet you could describe the framing w/o me saying a word.

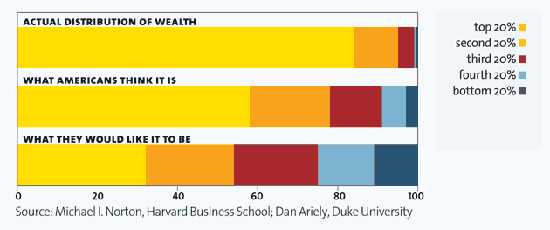

It looks like this:

You earn your money. It is yours. Then the government takes it away in the form of taxes (often referred to as theft) and gives it to someone who hasn’t earned it (redistribution).

When people you know say “socialism,” it is this process of taking from the “deserving” to give to the “undeserving” they are talking about.

I state this argument as strongly as possible here because this is what we’re up against. Professional, audience-tested propaganda.

If we, when you are talking to people, fall into arguing the side that wants to “redistribute,” you will be seen as someone who wants to use government to take away and give to the “lazy” or “undeserving”.

There is an easy way to flip this framing and talk about the actual situation with people you never thought you could reach.

All you have to do is talk about distributing it right to begin with.