Seven ways the wealthy raise taxes on the 99 percent after cutting them for themselves

One of the biggest lies told by conservative pundits is that one-half of Americans pay no taxes.

Conservatives like to throw around numbers, like the top 1 percent of wage earners will pay 45.7 percent of federal income taxes (from a 2014 report). This only tells a small part of the story.

For example, income tax accounts for less than one-half of federal taxes, and only one-fifth of taxes at all levels of government. Or that the top 1 percent receive 21 percent of total income.

What they also don’t tell you is that the 80 percent of taxes that aren’t income taxes tend to fall heavily on the the poor and middle class.

When you give massive tax cuts to the rich, as Donald Trump’s new tax plan proposes, what this means is that revenues will fall at the federal level. The federal government then cuts money to state governments, who cut money to local governments, who cut services and shift the costs onto the 99 percent.

What this strategy does is privatize profits for the wealthy, create stock bubbles, and push costs down to everyone else at the state, local, and individual level.

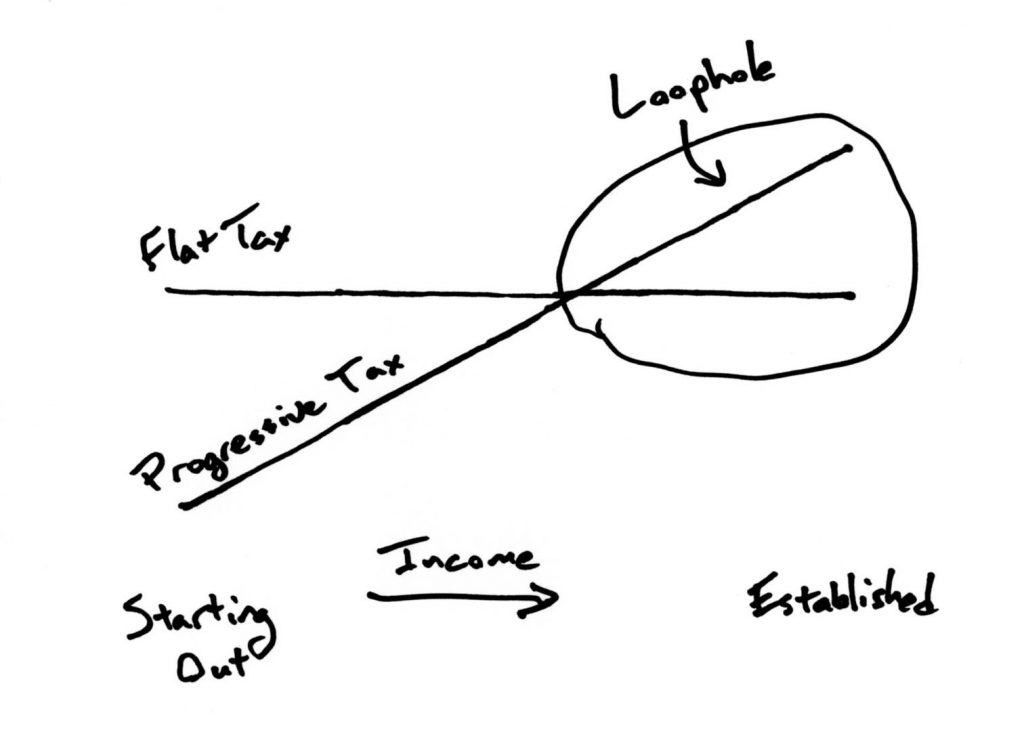

Here’s some of the regressive taxes that the 99 percent pay most of—and that are likely to increase if we write more tax loopholes for the rich.