How to explain in five minutes or less what happens when the rich get tax cuts

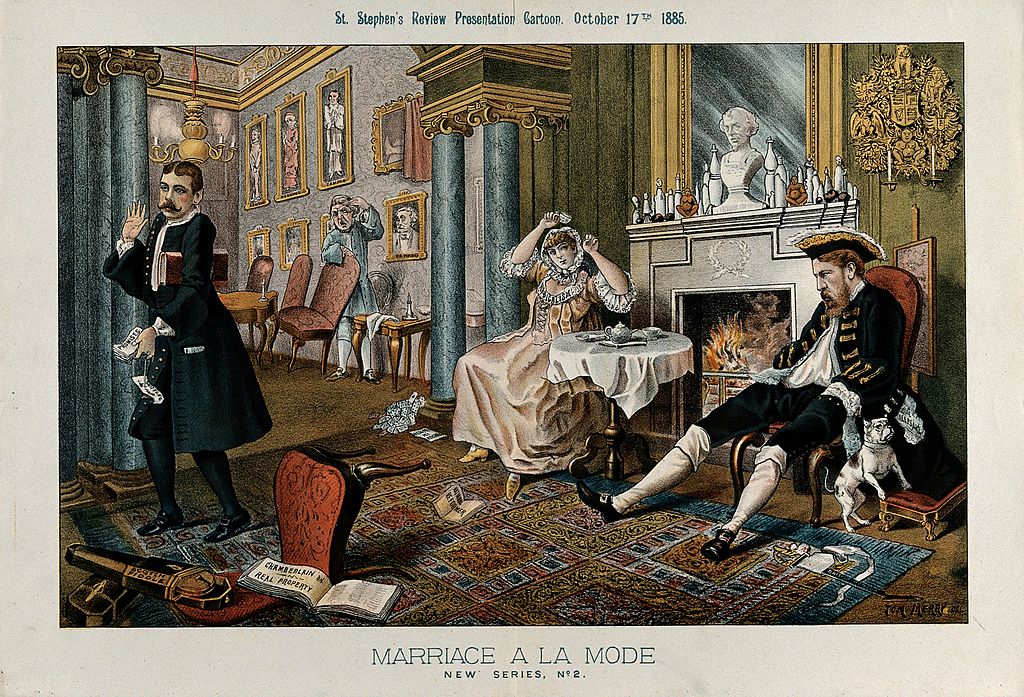

A political cartoon and a parody of the second scene of Hogarth’s Marriage a la Mode with politicians playing the main parts. A wealthy couple is having breakfast in a richly decorated room, the morning after a card party. (Wellcome Images/Wikimedia)

A political cartoon and a parody of the second scene of Hogarth’s Marriage a la Mode with politicians playing the main parts. A wealthy couple is having breakfast in a richly decorated room, the morning after a card party. (Wellcome Images/Wikimedia)

The corporate special interest group spin is that the rich will spend more if only we give them more in the form of tax cuts.

If people buy this story, then they think they’re doing the right thing by giving rich people tax cuts. That is, it doesn’t even matter if all of the benefits of the GOP tax bill are geared toward America’s wealthiest, because the wealthy will use this money to “create” more jobs as they say.

This is why it’s important to have a simple story about what really happens when the rich get tax cuts. Here’s how to explain in a way that makes it easy for people to understand in five minutes.