How to explain in five minutes or less what happens when the rich get tax cuts

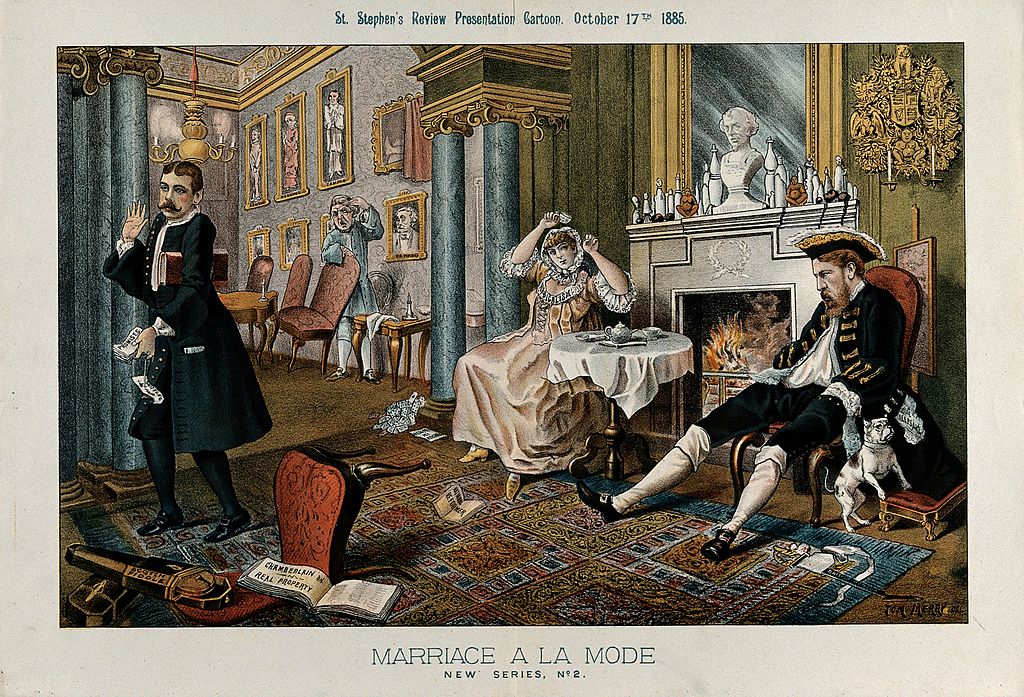

A political cartoon and a parody of the second scene of Hogarth’s Marriage a la Mode with politicians playing the main parts. A wealthy couple is having breakfast in a richly decorated room, the morning after a card party. (Wellcome Images/Wikimedia)

The corporate special interest group spin is that the rich will spend more if only we give them more in the form of tax cuts.

If people buy this story, then they think they’re doing the right thing by giving rich people tax cuts. That is, it doesn’t even matter if all of the benefits of the GOP tax bill are geared toward America’s wealthiest, because the wealthy will use this money to “create” more jobs as they say.

This is why it’s important to have a simple story about what really happens when the rich get tax cuts. Here’s how to explain in a way that makes it easy for people to understand in five minutes.

![]() Many conservatives believe that the way to a better economy is to give rich people more money. The person who asked the above question in my local conservative forum asked it because he wanted to make this argument that the wealthy “create” wealth.

Many conservatives believe that the way to a better economy is to give rich people more money. The person who asked the above question in my local conservative forum asked it because he wanted to make this argument that the wealthy “create” wealth.

I took him seriously and said, “Let’s look at what happens …”

1. Do the wealthy spend more?

The reason the wealthy don’t spend more is that they tend to already have everything they need or want.

The wealthy don’t spend more when they get tax cuts.

2. Do the wealthy invest in businesses they own?

Maybe.

Put yourself in the position of a business owner.

You invest in your business to create capacity only when demand is increasing, not when you receive a tax cut.

In other words, you only hire people when more orders are coming in and you need to produce more. This is basic supply and demand. You increase supply when demand increases.

You might invest in your business to make it more efficient. You might invest in technology, for example. If you’re making your business more efficient, though, you’re often laying people off.

The types of investments the wealthy make in their own businesses if they receive a tax cut don’t create jobs, and they don’t benefit anyone but the business owner (in terms of being more efficient).

3. Won’t investing in things that create efficiency like technology create other jobs?

It won’t create as many jobs as are lost.

If investing in efficiency created more jobs than it eliminated, it wouldn’t be “efficient.”

4. So what do the wealthy usually do when they get a tax cut?

The wealthy tend to put any tax cut savings they have in the stock market.

Now you might think … Great! All this money in the stock market will create jobs and we’ll see the economy improve.

Remember, though … Demand hasn’t increased.

The same market forces that caused the wealthy person to not invest in his own business are affecting all businesses.

If companies are investing, they’re not likely investing to increase production. They’re investing to make things more efficient. They’re investing to put people out of work or reduce their pay or cut their benefits.

So not only are they not going to hire more people, but these efficiency investments are likely to push consumer demand down further.

What happens then?

We get a stock bubble. When the wealthy get tax cuts, it creates a stock market bubble.

5. Don’t believe me?

Maybe you’ll believe Jude Wanniski. Jude Wanniski was a corporate lobbyist and one of the founders of the “supply side” propaganda.

In 1978, Jude Wanniski penned the article “A Bull Market Scenario” in the Wall Street Journal. Wanniski was asking a slightly different question. He wanted to juice the stock market:

What will it take to get the Dow Jones Industrial Average to a level of 3000 or 4000 by the early 1980s?

If you want the stock market to go up, the way to do this is to cut taxes on the wealthy and corporations (the capital gains tax, income taxes, corporate taxes, estate taxes, etc.). These taxes are taxes on accumulated wealth and capital. In Wanniski’s words:

The most important of these barriers are the now unnecessarily high federal tax rates on capital gains, personal incomes, and gifts and estates.

If you want to juice the stock market, eliminate taxes on accumulated wealth and capital. Certain tax cuts benefit Wall Street and the wealthy.

Taxes that don’t fall into this category are the taxes paid by everyday people: Sales taxes, property taxes, sin taxes, government fees, and tolls.

Look for these taxes to be raised.

Cutting taxes for the rich doesn’t boost the economy. It doesn’t boost demand. It doesn’t create jobs. It doesn’t help the middle class.

As Wanniski points out, these tax cuts benefit wealthy investors and juice the stock market. Which, of course, is why they usually sell these to us some other way: as jobs, as investment, as “freedom,” as a rising tide lifts all boats, as “great.”

6. Still don’t believe me?

Here’s Treasure Secretary Steve Mnuchin (formerly of Goldman Sachs) talking about the bubble he wants to create:

There is no question that the rally in the stock market has baked into it reasonably high expectations of us getting tax cuts and tax reform done. To the extent we get the tax deal done, the stock market will go up higher. But there’s no question in my mind that if we don’t get it done, you’re going to see a reversal of a significant amount of these gains.

Put simply: The stock market has gone up because it’s anticipating the government will work to create a bubble.

If we don’t follow through on this bubble, it will pop.

It won’t make the economy better. It won’t help the middle class. It won’t grow jobs. It won’t “trickle down.”

All it does is juice the stock market.

Coda

Now is a great time to have these types of conversations with people you know about the economy.

Many people think they’re doing the right thing by giving more to the wealthy in the hope that they’re improving the economy.

We may lose on tax legislation now. If we win the fight about what really makes a good economy, when the stock market bubble bursts down the road (as it inevitably has to), maybe we can do better.

Cross posted at Daily Kos.

David Akadjian is the author of The Little Book of Revolution: A Distributive Strategy for Democracy (ebook now available).